(Observing the effect of errors in estimating the bad debt expense and the allowance of uncollectable accounts...

Question:

(Observing the effect of errors in estimating the bad debt expense and the allowance of uncollectable accounts on the financial statements, LO 3, 4) Since 2002 Kyuquot Inc. (Kyuquot) has estimated that its bad debt expense would be approximately 3% of credit sales each year. In late 2003 Kyuquot made a number of changes to its internal control procedures that increased the effectiveness of its credit granting and receivables collection. As a result, in 2004 uncollectables decreased to about 2% of credit sales. However, the accounting department never bothered to lower the 3% rate that had been implemented in 2002.

The following information is also available about Kyuquot’s receivables and bad debts:

i. Kyuquot’s year end is December 31.

ii. The balance in Kyuquot’s allowance account on January 1, 2002 was $19,600.

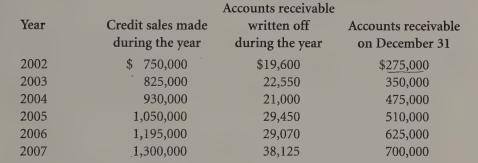

iii. Credit sales and write-offs by year and accounts receivable on December 31 of each year were:

Required:

a. Calculate Kyuquot’s bad debt expense in each year from 2002 through 2007.

b. Calculate the balance in Allowance for Uncollectable Accounts on December 31 of each year, after the adjusting entry recording the bad debt expense for the year was made.

c. Examine the balance in the allowance account over the period from 2002 through 2007. Explain what is happening to the allowance account as a result of using a percentage of credit sales that is consistently too high. (To answer, it may help to look at the balance in the allowance account as a percentage of Accounts Receivable.)

d. What is the effect on income each year of using a percentage of credit sales that is consistently too large? Explain.

e. What is the net amount of accounts receivable (accounts receivable — allowance for uncollectables) on Kyuquot’s balance sheet on December 31, 2007? Does the balance on the balance sheet represent the net realizable value of the accounts receivable on December 31, 2007? Explain.

f. What would the balance in the allowance account be on December 31, 2007, after the adjusting entry for bad debts is made, if Kyuquot expensed 2% of credit sales as bad debts beginning in 2007?

g. Suppose that in 2007 management become aware of the error it was making estimating bad debts each year by using 3% of credit sales instead of 2%. What journal entry would Kyuquot have to make to reduce the balance in the allowance account to $35,000? What would be the effect of this journal entry on net income in 2007? What are some of the implications of these errors on users of the financial statements?

Step by Step Answer: