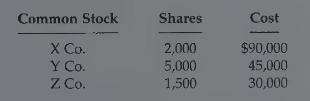

On December 31, 1996, Karen Associates owned the following securities that are held as a long-term investment.

Question:

On December 31, 1996, Karen Associates owned the following securities that are held as a long-term investment. The securities are not held for influence or control of the investee.

On this date, the total fair value of the securities was equal to its cost. In 1997, the following transactions occurred.

July 1 Received \(\$ 1\) per share semiannual cash dividend on \(Y\) Co. common stock.

Aug. 1 Received \(\$ .50\) per share cash dividend on \(X\) Co. common stock.

Sept. 1 Sold 700 shares of \(Y\) Co. common stock for cash at \(\$ 8\) per share less brokerage fees of \(\$ 200\).

Oct. 1 Sold 600 shares of \(\mathrm{X}\) Co. common stock for cash at \(\$ 54\) per share less brokerage fees of \(\$ 500\).

Nov. 1 Received \(\$ 1\) per share cash dividend on \(\mathrm{Z}\) Co. common stock.

Dec. 15 Received \(\$ .50\) per share cash dividend on \(X\) Co. common stock.

31 Received \(\$ 1\) per share semiannual cash dividend on \(Y\) Co. common stock.

At December 31 , the fair values per share of the common stocks were: X Co. \(\$ 48, \mathrm{Y}\) Co. \(\$ 8\), and \(\mathrm{Z}\) Co. \(\$ 17\).

\section*{Instructions}

(a) Journalize the 1997 transactions and post to the account Stock Investments. (Use the T-account form.)

(b) Prepare the adjusting entry at December 31, 1997, to show the securities at fair value. The stock should be classified as available-for-sale securities.

(c) Show the balance sheet presentation of the investments and the unrealized gain (loss) at December 31, 1997. At this date, Karen Associates has common stock \(\$ 1,500,000\) and retained earnings \(\$ 1,000,000\).

Step by Step Answer:

Financial Accounting

ISBN: 9780471169208

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso