(Payback) H & H Variety Store is considering a new product line, a flower shop. The new...

Question:

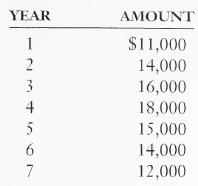

(Payback) H & H Variety Store is considering a new product line, a flower shop. The new product line would require an investment of $30,000 in equipment and fixtures and $20,000 in working capital. H & H managers expect the following pattern of net cash inflows from the new flower shop over the life of the investment.

a. Compute the payback period for the proposed flower shop. If H & H re¬ quires a 4-year pretax payback on its investments, should it invest in the new product line? Explain.

b. Should H & H use any other capital project evaluation methods before mak¬ ing an investment decision? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: