Pipestone Ltd. (Pipestone) uses an aging schedule to estimate the amount of receivables that wont be collected.

Question:

Pipestone Ltd. (Pipestone) uses an aging schedule to estimate the amount of receivables that won’t be collected. Pipestone allows its customers up to 30 days to pay amounts owed. Any receivable outstanding for more than 30 days is considered overdue. Based on historical information management estimates that it will collect 98 percent of current accounts receivable, 92 percent of receivables overdue by between 1 and 30 days, 80 percent of receivables overdue by between 31 and 60 days, 50 percent of receivables overdue by between 61 and 90 days, and 25 percent of receivables overdue by more than 90 days.

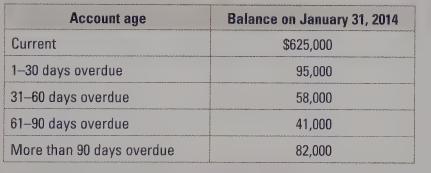

Management has provided you with the following aged receivable schedule:

The balance in allowance for uncollectible accounts before the period-end adjusting entry is made is a credit of $7,300.

Required:

a. What amount of ending accounts receivable is estimated to be uncollectible on January 31, 2014?

b. Prepare the journal entry required to record the bad debt expense for Pipestone for the year ended January 31, 2014.

Step by Step Answer: