(Preparation of a consolidated balance sheet on the date a subsidiary is purchased, LO 1) On August...

Question:

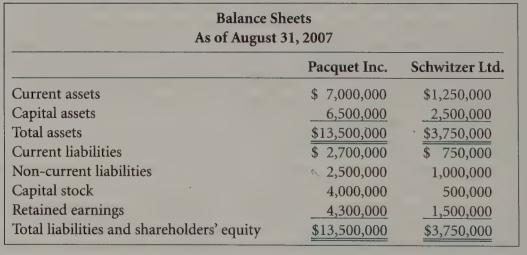

(Preparation of a consolidated balance sheet on the date a subsidiary is purchased, LO 1) On August 31, 2007 Pacquet Inc. (Pacquet) purchased 100% of the common shares of Schwitzer Ltd. (Schwitzer) for $4,000,000 cash. Pacquet’s and Schwitzer’s balance sheets on August 31, 2007 just before the purchase were:

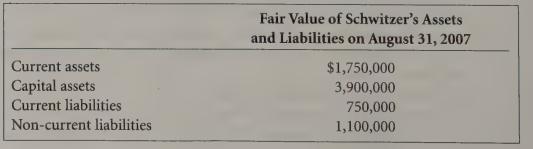

Management determined that the fair values of Schwitzer’s assets and liabilities were as follows:

Required

a. Prepare the journal entry that Pacquet would prepare to record its purchase of Schwitzer’s shares.

b. Prepare the journal entry that Schwitzer would prepare to record its purchase by Pacquet.

c. Prepare Pacquet’s balance sheet immediately following the purchase.

d. Calculate the amount of goodwill that would be reported on Pacquet’s consolidated balance sheet on August 31, 2007.

e. Prepare Pacquet’s consolidated balance sheet on August 31, 2007.

f. Calculate the current ratios and debt-to-equity ratios for Pacquet, Schwitzer, and for the consolidated balance sheet. Interpret the differences between the ratios. When calculating the ratios, use Pacquet and Schwitzer’s balance sheets after the purchase had been made and recorded.

g. You are a lender who has been asked to make a sizeable loan to Schwitzer.

Which balance sheets would you be interested in viewing? Explain. How would you use Pacquet’s consolidated financial statements in making your lending decision?

Step by Step Answer: