(Preparing income statements under different revenue-recognition methods, LO 1, 2, 3, 6) Igloolik Mines Inc. (Igloolik) operates...

Question:

(Preparing income statements under different revenue-recognition methods, LO 1, 2, 3, 6) Igloolik Mines Inc. (Igloolik) operates three nickel mines in the Yukon.

In 2002 gold was discovered on one of its mining properties and Igloolik developed the gold mine. The gold mine went into production in 2004. The ore is extracted from the ground and refined into pure gold at a refinery that Igloolik built on the mine property. The gold is stored until it is shipped to customers. The following information on the contracts and the operation of the mine is obtained from the mine manager: :

i. In the first three years the mine was in production, 30,000 ounces of gold were produced in each year.

ii. Just before the mine began production, Igloolik had signed contracts with several buyers to purchase 30,000 ounces of gold per year for the next three years.

iii. The contracts set the purchase price that the customers must pay for the gold each year at $420 per ounce for each ounce of gold delivered.

iv. The cost of mining, refining, and delivering an ounce of gold to customers in the first three years was $275 per ounce in the first year, $290 per ounce in the second year, and $300 per ounce in the third year. These costs are accounted for as product costs.

v. Amortization expense in each of the first three years was $1,600,000.

vi. Other non-production costs were $1,000,000 in the first year, $1,050,000 in the second year, and $900,000 in the third year.

vii. The mine pays 30% of income before taxes in income taxes.

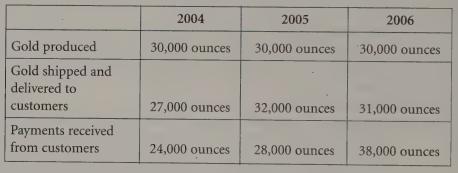

viii. Other information:

Required:

a. Prepare an income statement for each of the three years assuming that: i. Revenue is recognized when a contract is signed.

li. Revenue is recognized when the gold is produced.

lil. Revenue is recognized when the gold is shipped and delivered to customers. iv. Revenue is recognized when payment is received from customers. When preparing the statements, assume that the cost of mining, refining, and delivery of the gold is accounted for as a product cost, and the amortization expense and the non-production costs are accounted for as period costs.

b. Which objective of financial reporting would be served by each method of rec- ognizing revenue?

c. Under GAAP, which revenue-recognition methods could be justified? Try to think of circumstances that would allow you to justify using each of the four revenue-recognition points.

Step by Step Answer: