(Preparing journal entries for percentage-of-completion and completed-contract methods, LO 3, 4) Hazelbrook Corp. (Hazelbrook) is a custom...

Question:

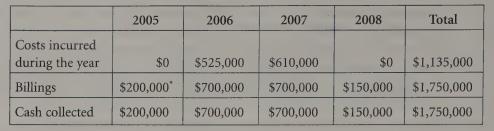

(Preparing journal entries for percentage-of-completion and completed-contract methods, LO 3, 4) Hazelbrook Corp. (Hazelbrook) is a custom builder of luxury homes. On November 27, 2005 Hazelbrook signed a contract to build a mansion just outside of Charlottetown for an entrepreneur who made a fortune selling her stake in an e-business to a large US company. The entrepreneur agreed to pay $1,750,000 for the mansion. At the time the contract was signed, the entrepreneur paid Hazelbrook $200,000. Construction is scheduled to begin in March 2006 and end in late 2007. The contract stipulates that the final $150,000 must be paid six months after the entrepreneur takes possession of the mansion.

Required:

a. Prepare the transactional journal entries that would be prepared each year by Hazelbrook.

b. Prepare the journal entries that Hazelbrook would make if it recognized revyenue using the completed-contract method.

c. Prepare the journal entries that Hazelbrook would make if it recognized revenue using the percentage-of-completion method. Use the costs incurred during each year divided by total costs to estimate the percentage completed.

Step by Step Answer: