Reitmans (Canada) Limited is a Canadian retailer that specializes in the sale of womens wear. Exhibits 9.8A

Question:

Reitmans (Canada) Limited is a Canadian retailer that specializes in the sale of women’s wear. Exhibits 9.8A to 9.8C contain information from the company’s 2017 annual report. All figures are expressed in thousands of dollars.

EXHIBIT 9.8A Excerpt from Reitmans’ 2017 Annual Report, Management Discussion and Analysis

The Company has unsecured borrowing and working capital credit facilities available up to an amount of $75 million or its U.S. dollar equivalent. As at January 28, 2017, $9.7 million (January 30, 2016 – $14.1 million) of the operating lines of credit were committed for documentary and standby letters of credit. These credit facilities are used principally for U.S. dollar letters of credit to satisfy international third-party vendors which require such backing before confirming purchase orders issued by the Company and to support U.S. dollar foreign exchange forward contract purchases. The Company rarely uses such credit facilities for other purposes. The reduction in the commitments under the operating lines of credit reflects the Company’s initiative to change payment settlement from documentary letters of credit towards open credit. The Company has granted irrevocable standby letters of credit, issued by highly-rated financial institutions, to third parties to indemnify them in the event the Company does not perform its contractual obligations. As at January 28, 2017, the maximum potential liability under these guarantees was $2.8 million (January 30, 2016 – $2.8 million). The standby letters of credit mature at various dates during fiscal 2018. The Company has recorded no liability with respect to these guarantees, as the Company does not expect to make any payments for these items.

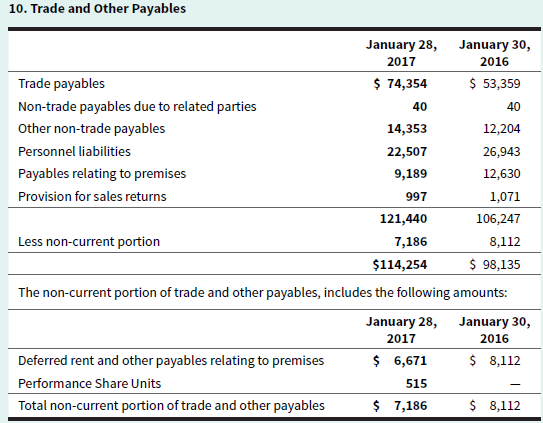

EXHIBIT 9.8B Excerpt from Reitmans’ 2017 Annual Report, Note 10

EXHIBIT 9.8C Excerpt from Reitmans’ 2017 Annual Report, Note 3(O)

O) Revenue

Revenue is recognized from the sale of merchandise when a customer purchases and takes delivery of the merchandise. Reported sales are net of returns and estimated possible returns and exclude sales taxes.

Gift cards sold are recorded as deferred revenue and revenue is recognized when the gift cards are redeemed. An estimate is made of gift cards not expected to be redeemed based on historical redemption patterns.

Loyalty points and awards granted under customer loyalty programs are recorded as deferred revenue at the date of initial sale. Revenue is recognized when the loyalty points and awards are redeemed and the Company has fulfilled its obligation. The amount of revenue deferred is measured based on the fair value of loyalty points and awards granted, taking into consideration the estimated redemption percentage.

Required

a. Refer to Exhibit 9.8A. Explain why Reitmans uses letters of credit and how the working capital loan relates to them.

b. Refer to Exhibit 9.8B. If Reitmans’ costs of goods sold for the year ending January 28, 2017, was $429,606 thousand and the company began the year with $124,848 thousand in inventory and ended with $146,059 thousand, calculate the accounts payable turnover ratio and average payment period.

c. Refer to Exhibit 9.8C and explain in your own words how Reitmans accounts for deferred revenue.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley