Sayabec Ltd.s (Sayabec) purchases for 2015 were The beginning balance in inventory on January 1, 2015 was

Question:

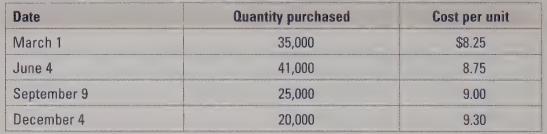

Sayabec Ltd.’s (Sayabec) purchases for 2015 were

The beginning balance in inventory on January 1, 2015 was 46,000 units with a cost of \($8\) per unit. The inventory count on December 31, 2015 found that there were 39,000 units on hand at the end of the year. Sayabec uses a periodic inventory control system.

During 2015 Sayabec had revenues of \($2,984,000\) and expenses other than the cost of sales and taxes of \($1,525,000\). Sayabec pays taxes equal to 18 percent of its income before taxes.

Required

a. Prepare income statements for 2015 for Sayabec using FIFO and average cost. Your income statements should show the amount of taxes the company has to pay for the income it earned in 2015. Taxes are calculated by multiplying income before taxes (revenue — all expenses except taxes) by the tax rate.

b. Which method would you recommend that Sayabec use if its primary objective of financial reporting is to minimize taxes? Explain your answer.

c. What are possible explanations as to why Sayabec would choose not to use the method you recommended in (b)?

Step by Step Answer: