Simpson Ltd. (Simpson) imports novelty items from Asian manufacturers and sells them to retailers. The company began

Question:

Simpson Ltd. (Simpson) imports novelty items from Asian manufacturers and sells them to retailers. The company began operations at the beginning of 2015. The following information is available about Simpson’s operation:

* Simpson’s suppliers allow it 30 days to pay for purchases. Assume purchases are made evenly throughout the year.

* Simpson allows customers 60 days to pay for their purchases. Assume sales occur evenly throughout the year.

* Simpson has a markup on its product of 100 percent. (If a customer purchases merchandise that costs Simpson \($1\) the customer pays $2.)

* Operating costs, other than the cost of product sold, are \($40,000\) per quarter. These costs are paid in cash during the quarter.

* Simpson began operations with \($100,000\) in cash contributed by its shareholders.

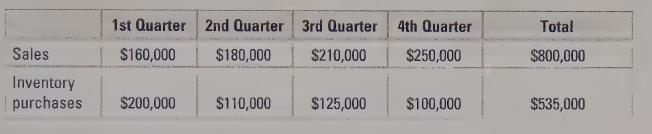

* Quarterly information for 2015:

Required:

a. Prepare income statements for each quarter of 2015 and for the entire year.

(Hint: Use the fact that Simpson has a 100 percent markup to calculate cost of goods sold.)

b. Calculate the amount of inventory on hand at the end of each quarter and the end of the year.

c. Calculate the amount of accounts receivable at the end of each quarter and the end of the year.

d. Calculate the amount of accounts payable at the end of each quarter and the end of the year.

e. Calculate the amount of cash on hand at the end of each quarter and the end of the year. What was the net cash flow for each quarter and the year?

f. Explain the difference between net income and net cash flow during 2015.

Evaluate Simpson’s liquidity during 2015. What could be done to improve Simpson’s liquidity?

g. What would net income be if Simpson gave customers 90 days to pay? What would net cash flow be? Discuss your results compared with when customers had 60 days to pay.

Step by Step Answer: