Singh Company started business on January 1, 2020. The following transactions occurred in 2020: 1. On January

Question:

Singh Company started business on January 1, 2020. The following transactions occurred in 2020:

1. On January 1, the company issued 10,000 common shares for $250,000.

2. On January 2, the company borrowed $50,000 from the bank.

3. On January 3, the company purchased land and a building for a total of $200,000 cash. The land was recently appraised at a fair market value of $60,000. (Because the building will be depreciated in the future and the land will not, these two assets should be recorded in separate accounts.)

4. Inventory costing $130,000 was purchased on account.

5. Sales to customers totalled $205,000. Of these, $175,000 were sales on account.

6. The cost of the inventory that was sold to customers in transaction 5 was $120,000.

7. Payments to suppliers on account totalled $115,000.

8. Collections from customers on account totalled $155,000.

9. Payments to employees for wages were $55,000. In addition, there was $2,000 of unpaid wages at year end.

10. The interest on the bank loan was recognized for the year. The interest rate on the loan was 6%.

11. The building was estimated to have a useful life of 30 years and a residual value of $20,000. The company uses the straight-line method of depreciation.

12. The company declared dividends of $7,000 on December 15, 2020, to be paid on January 15, 2021.

Required

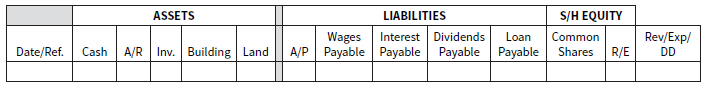

a. Analyze the effects of each transaction on the basic accounting equation, using a template like the one below:

b. Prepare a statement of income, a statement of changes in equity, a statement of financial position (unclassified), and a statement of cash flows for 2020.

b. Prepare a statement of income, a statement of changes in equity, a statement of financial position (unclassified), and a statement of cash flows for 2020.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley