Spin Master Corp. is a Toronto-based company that designs, markets, and sells entertainment products for children. Exhibit

Question:

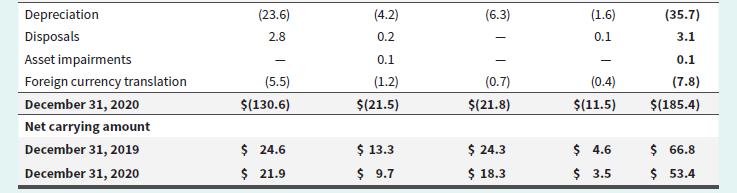

Spin Master Corp. is a Toronto-based company that designs, markets, and sells entertainment products for children. Exhibit 8.30 is an extract from Spin Master’s consolidated financial statements for its year ended December 31, 2020.

Required

a. Determine the average age percentage of Spin Master’s moulds, dies, and tools. Does this make sense given the company’s depreciation estimates for them?

b. Spin Master recorded depreciation on its computer hardware in the amount of $1.4 million for its 2020 fiscal year. Compare the estimated useful life for computer hardware used by Spin Master with that used by Dollarama. Explain what might be the reason for the difference.

c. What is management saying about the expected useful life of its machinery and equipment, given the depreciation method used for them?

d. The net carrying amount of Spin Master’s property, plant, and equipment at December 31, 2020, was $53.4 million. If Spin Master’s sales revenue was $1,570.6 million for the 2020 fiscal year, determine the company’s fixed asset turnover ratio. Explain what you can tell about Spin Master based on the result of this ratio.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley