Sundre Trucking Inc. (Sundre) is a small shipping company that carries goods between locations in western Canada

Question:

Sundre Trucking Inc. (Sundre) is a small shipping company that carries goods between locations in western Canada and the northwestern United States. The Archer family of Pagish owns Sundre but professional managers manage it. One member of the Archer family serves as the chair of the board of directors.

No other family members are actively involved with Sundre.

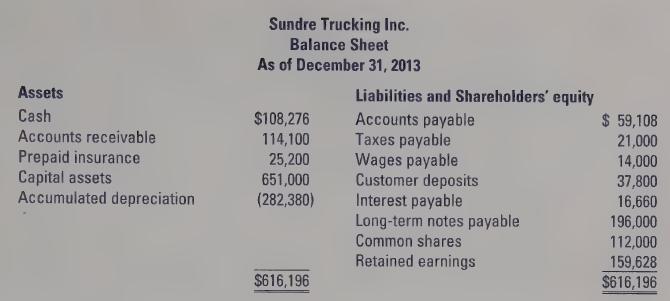

Sundre’s balance sheet for the year ended December 31, 2013 is shown below.

Sundre uses its financial statements for tax purposes, to show to the holders of the long-term notes that the company issted to finance the purchase of some of its trucks, and to provide information to the shareholders.

It's now January 2015. Sundre needs to prepare its financial statements for the year ended December 31, 2014. The following information has been obtained about the fiscal year just ended:

i. Shipping revenue for the year was $1,491,315. Sundre gives credit to all its customers and there were no cash sales during the year.

ii. Sundre purchased $385,000 worth of fuel during the year. All purchases were on credit. At the end of 2014 Sundre had not been billed for an additional $14,000 of fuel it purchased.

ii. Sundre incurred maintenance costs of $175,000 during 2014. At the end of 2014 Sundre owed mechanics $11,200.

iv. Sundre paid salaries and bonuses of $665,000 to employees, including the amounts owing on December 31, 2013. At December 31, 2014 Sundre owed employees $38,500.

v. During the year Sundre collected $1,505,000 from customers.

vi. Sundre paid its fuel suppliers $350,000 during 2014.

vii. During the year Sundre paid the taxes it owed at the end of 2013. It also paid $15,400 in instalments on its 2014 income taxes. Sundre estimates that it owes an additional $16,800 in income taxes for 2014.

vili. The deposits reported on the 2013 balance sheet pertained to customers who were perceived to be high risk and to whom Sundre wasn’t prepared to offer credit. These customers were required to give deposits against shipping to be done during 2014. These customers used shipping services during 2014 in excess of the amount of the deposits. Sundre decided in 2014 to offer credit to these customers.

ix. Members of the Archer family sometimes use Sundre employees for personal work at their homes and cottages. Usually the work is done on weekends and the employees are paid at overtime rates. Sundre pays the employees’ wages for the work done for the family members and accounts for the cost as a wage expense.

The wages paid for work done on behalf of Archer family members was $15,400.

x. During 2014 Sundre purchased a new truck for $137,200 in cash.

xi. Depreciation expense for 2014 was $67,200.

xii. Prepaid insurance pertains to insurance on its truck fleet and premises. During 2014 it used $21,000 of insurance that was recorded as prepaid on December 31, 2013. In late 2014 Sundre purchased and paid $29,400 for insurance for 2015.

xiii. During the year Sundre paid $16,660 in interest to the holders of the long-term notes. Interest is paid annually on January 2. In addition to the interest payment Sundre paid $28,000 on January 2, 2014 to reduce the balance owed on the longterm notes. The interest rate on the notes is 7.5 percent.

xiv. Sundre paid $105,000 in cash for other expenses related to operating the business in fiscal 2014.

xv. Sundre paid dividends of $77,000 to shareholders.

Required:

a. Enter each of the transactions onto an accounting equation spreadsheet. You can use a computer spreadsheet program or create a spreadsheet manually. Create a separate column on the spreadsheet for each account. Make sure to prepare all adjusting entries and the closing entry. Indicate whether each entry is a transactional entry, an adjusting entry, or a closing entry.

b. Provide explanations for each of your entries. You should explain why you have treated the economic events as you have (that is, why you have recorded an asset, liability, etc.).

c. Prepare a balance sheet as of December 31, 2014 and an income statement for the year ended December 31, 2014 from your spreadsheet.

d. The North American economy is booming and there is a lot of work for shipping companies like Sundre. However, the competition is fierce and success and failure are defined by how efficient a company is and how well it services its customers.

Sundre’s managers would like to upgrade its fleet by adding two new trucks and making significant improvements to its existing vehicles. Based on your examination of the statements, what can you tell about Sundre that would be useful to your decision to lend it $125,000? Also, list five questions you might ask Sundre’s management that would help you use the financial statements more effectively.

Step by Step Answer: