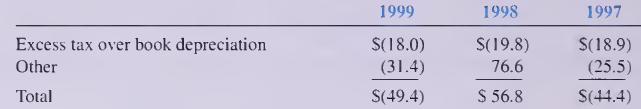

The annual report for Colgate-Palmolive contains the following information (in millions): Income Taxes Differences between accounting for

Question:

The annual report for Colgate-Palmolive contains the following information (in millions):

Income Taxes Differences between accounting for financial statement purposes and accounting for tax purposes result in taxes currently payable (lower) higher than the total provision for income taxes as follows:

Required: 1. Determine whether tax expense is higher or lower than taxes payable for each year. 2. Explain the most likely reason for tax depreciation to be higher than book depreciation. 3. Is the deferred tax liability reported on the 1999 balance sheet $49.4 million? Explain.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: