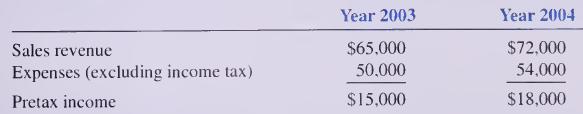

The comparative income statements of Martin Corporation at December 31, 2004, showed the following summarized pretax data:

Question:

The comparative income statements of Martin Corporation at December 31, 2004, showed the following summarized pretax data:

Included in the 2004 data is a $2,800 expense that was deductible only in the 2003 income tax return (rather than in 2004). The average income tax rate was 30 percent. Taxable income from the income tax returns was 2003, $14,000, and 2004, $17,400.

Required: 1. For each year, compute

(a) income taxes payable and

(b) deferred income tax. Is the deferred income tax a liability or an asset? Explain. 2. Show what amounts related to income taxes should be reported each year on the income statement and balance sheet. Assume that income tax is paid on April 15 of the next year. 3. Explain why tax expense is not simply the amount of cash paid during the year.

Step by Step Answer: