(The effect of leasing on ratios, LO 2) Fodhia Inc. (Fodhia) is a small manufacturing company operating...

Question:

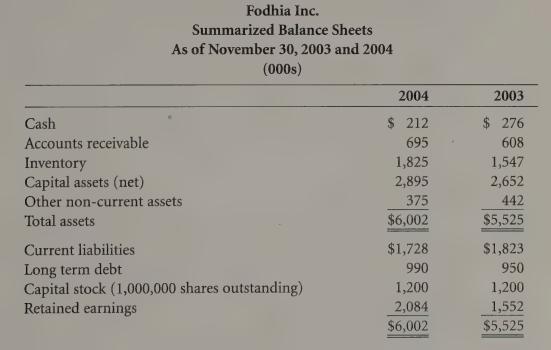

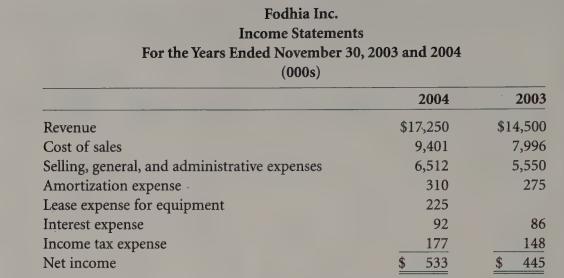

(The effect of leasing on ratios, LO 2) Fodhia Inc. (Fodhia) is a small manufacturing company operating in eastern Canada. Fodhia is a public company. In 2004 Fodhia’s management decided to acquire additional manufacturing equipment so that it would be able to meet the increasing demand for its products. However, instead of purchasing the equipment, Fodhia arranged to lease the equipment. The lease came into effect on December 1, 2003. In its 2004 financial statements Fodhia accounted for the leases as operating leases. You have obtained Fodhia’s summarized balance sheets and income statements for 2003 and 2004.

Had Fodhia accounted for the equipment leases as capital leases, the following differences would have occurred in the 2004 financial statements:

Required:

No lease expense would have been recorded.

The leased equipment would have been recorded on the balance sheet as capital assets for $460,000. The equipment will be amortized straight-line over 12 years.

A liability of $460,000 would have been recorded at the inception of the lease.

On November 30, 2004 the current portion of the liability would have been $75,000. The interest expense arising from the lease would have been $46,000.

On November 30, 2004 the remaining liability, including the current portion, would have been $431,000.

There would be no effect on the tax expense for the year.

Prepare revised financial statements, assuming that Fodhia treated the leases as capital leases instead of as operating leases.

Calculate the following ratios, first-using the financial statements as initially prepared by Fodhia and then using the revised statements you prepared in part (a):

i. debt-to-equity ratio ii. return on assets ili. return on equity iv. profit margin ratio v. current ratio vi. asset turnover vii. earnings per share vill. interest coverage ratio Discuss the differences between the two sets of ratios you calculated in part (b). Why are the ratios different? How might users of the financial statements be affected by these differences? Which set of ratios gives a better perspective on the performance, liquidity, and leverage of Fodhia? Explain.

Step by Step Answer: