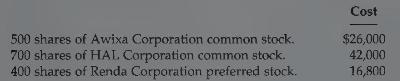

The following are in Hi-Tech Company's portfolio of long-term available-for-sale securities at December 31, 1995: On December

Question:

The following are in Hi-Tech Company's portfolio of long-term available-for-sale securities at December 31, 1995:

On December 31, the total cost of the portfolio equaled total fair value. Hi-Tech had the following transactions related to the securities during 1996:

On December 31, the total cost of the portfolio equaled total fair value. Hi-Tech had the following transactions related to the securities during 1996:

Jan. 7 Sold 500 shares of Awixa Corporation common stock at \(\$ 56\) per share less brokerage fees of \(\$ 700\).

Jan. 10 Purchased 200 shares, \(\$ 70\) par value common stock of Mintor Corporation at \(\$ 78\) per share, plus brokerage fees of \(\$ 240\).

26 Received a cash dividend of \(\$ 1.15\) per share on HAL Corporation common stock.

Feb. 2 Received cash dividends of \(\$ .40\) per share on Renda Corporation preferred stock.

10 Sold all 400 shares of Renda Corporation preferred stock at \(\$ 28.00\) per share less brokerage fees of \(\$ 180\).

July 1 Received a cash dividend of \(\$ 1.00\) per share on HAL Corporation common stock.

Sept. 1 Purchased an additional 400 shares of the \(\$ 70\) par value common stock of Mintor Corporation at \(\$ 82\) per share, plus brokerage fees of \(\$ 400\).

Dec. 15 Received a cash dividend of \(\$ 1.50\) per share on Mintor Corporation common stock.

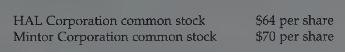

At December 31, 1996, the fair values of the securities were:

Hi-Tech uses separate account titles for each investment, such as Investment in HAL Corporation Common Stock.

\section*{Instructions}

(a) Prepare journal entries to record the transactions.

(b) Post to the investment accounts. (Use T accounts.)

(c) Prepare the adjusting entry at December 31, 1996, to report the porfolio at fair value.

(d) Show the balance sheet presentation at December 31, 1996

Step by Step Answer:

Financial Accounting

ISBN: 9780471169208

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso