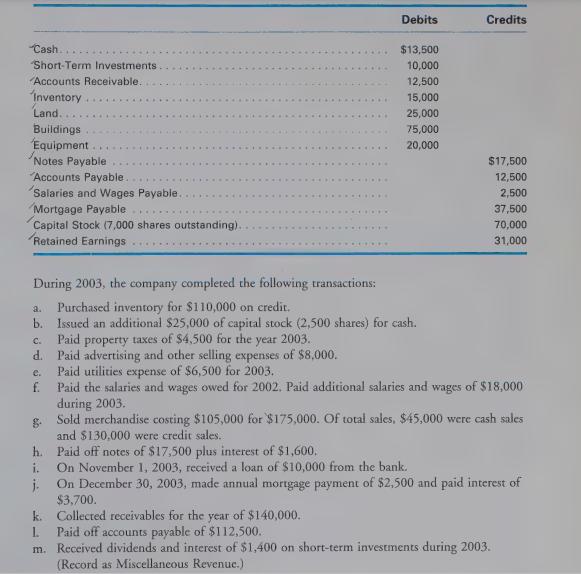

The following balances were taken from the general ledger of Benson Company on January 1, 2003: n.

Question:

The following balances were taken from the general ledger of Benson Company on January 1, 2003:

n. Purchased additional short-term investments of $15,000 during 2003. (Note: Short-term investments are current assets.) O. Paid 2003 corporate income taxes of $11,600. p. Paid cash dividends of $7,600. 1. Journalize the 2003 transactions. (Omit explanations.) 2. Set up T-accounts with the proper account balances at January 1, 2003, and post the journal entries to the T-accounts. 3. Determine the account balances, and prepare a trial balance at December 31, 2003. 4. Prepare an income statement and a balance sheet. (Remember that the dividends account and all revenue and expense accounts are temporary retained earnings accounts.) 5. Interpretive Question: Why are revenue and expense accounts used at all?

Step by Step Answer:

Financial Accounting

ISBN: 9780324066708

8th Edition

Authors: W. Steven Albrecht, James D. Stice, Earl Kay Stice, K. Fred Skousen, Albrecht S.E.