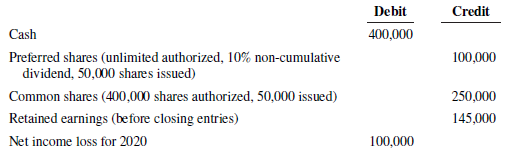

The following selected financial information was extracted from the December 31, 2020, financial records of Moratti Company:

Question:

The following selected financial information was extracted from the December 31, 2020, financial records of Moratti Company:

The company’s board of directors is contemplating declaring a dividend on common shares. The company’s common shares are currently selling for $7 per share. Moratti’s board is also expected to declare a preferred shared dividend of 10%.

Required

a. Moratti is considering a cash dividend and would like to maximize the size of its dividend. Determine how large a cash dividend the board of directors can consider.

b. How large a stock dividend can the board legally declare on the company’s common shares?

c. Prepare journal entries for the maximum dividend in each of parts “a” and “b” above including closing entries for net loss and dividends declared and paid on preferred shares.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley