(The impact of non-arms length transactions and entity assumption, LO 2, 4) Norboro Software Development Inc. (Norboro)...

Question:

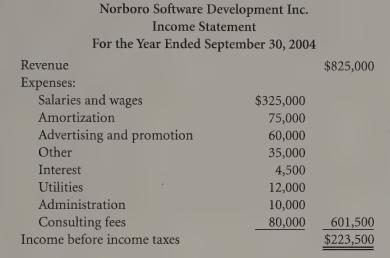

(The impact of non-arm’s length transactions and entity assumption, LO 2, 4) Norboro Software Development Inc. (Norboro) is a small software development company that specializes in customizing computer software for small- to mediumsized professional practices. Norboro has developed a number of proprietary software packages that it modifies for clients. Norboro also modifies existing commercial packages to suit the needs of clients. Norboro is owned by James and Anita Norboro; each owns 50% of the shares of the company. Recently the Norboros were approached about selling their business to a competitor that is looking to expand. The Norboros are thinking seriously about selling and they have provided the following income statement for the year ended September 30, 2004:

In discussions with the Norboros the prospective buyer has obtained some important information about the business. Norboro was originally financed five years ago by a $200,000 interest free loan from Anita Norboro’s parents. An equivalent loan from the bank would have an interest rate of about 10%. The loan has not yet been repaid. The salaries and wages expense includes $60,000 per year that is paid to James and $60,000 per year that is paid to Anita. Anita does not work in the business, except to help out from time to time with some of the administration. If Norboro had to hire an employee to do the work done by Anita, the cost would be about $15,000. Hiring a person to do the work James does would cost about $75,000.

Norboro’s offices are located in a building owned by Anita. The company pays no rent for the space. Equivalent space in the building rents for about $100,000 per year.

The consulting fees pertain to service provided by another company owned by James Norboro. These services are provided to Norboro Software Development Inc. at about 10% below the usual market rate.

Required:

a. Are the financial statements as shown above an appropriate basis for the is prospective buyer to assess Norboro? Explain.

b. You have been asked by the prospective buyer of Norboro to recast the financial statements for the year ended September 30, 2004 as if the buyer had operated the company.

Step by Step Answer: