The Ortega Security Service Inc. began operations on January 1, 1996. At the end of the first

Question:

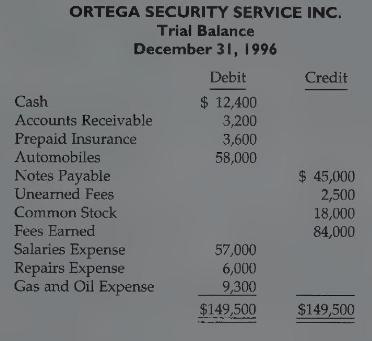

The Ortega Security Service Inc. began operations on January 1, 1996. At the end of the first year of operations, the trial balance before adjustment shows the following:

Other data:

1. Fees earned but unbilled \(\$ 1,500\) at December 31 .

2. Insurance coverage began on January 1 under a 2 -year policy.

3. Automobile depreciation is \(\$ 15,000\) for the year.

4. Interest of \(\$ 5,400\) accrued on notes payable for the year.

5. \(\$ 1,000\) of the unearned fees has been earned.

6. Drivers' salaries total \(\$ 500\) per day. At December 31,4 days' salaries are unpaid.

7. Repairs to automobiles of \(\$ 650\) have been incurred, but bills have not been received prior to December 31. (Use Accounts Payable.)

Instructions

(a) Journalize the annual adjusting entries at December 31, 1996 .

(b) Prepare a ledger using the three-column account form. Enter the trial balance amounts and post the adjusting entries. (Use J15 as the posting reference.)

(c) Prepare an adjusted trial balance at December 31, 1996.

Step by Step Answer:

Financial Accounting

ISBN: 9780471169208

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso