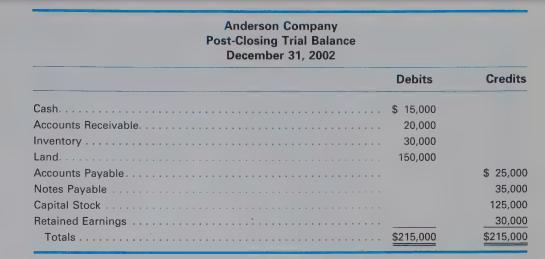

The post-closing trial balance of Anderson Company at December 31, 2002, is shown here. During 2003, Anderson

Question:

The post-closing trial balance of Anderson Company at December 31, 2002, is shown here.

During 2003, Anderson Company had the following transactions:

a. Inventory purchases were $80,000, all on credit (debit Inventory).

b. An additional $10,000 of capital stock was issued for cash. Merchandise that cost $100,000 was sold for $180,000; $100,000 were credit sales and the balance were cash sales. (Debit Cost of Goods Sold and credit Inventory for sale of merchandise.) The notes were paid, including $7,000 interest. $105,000 was collected from customers. $95,000 was paid to reduce accounts payable. Salaries expense was $30,000, all paid in cash. A $10,000 cash dividend was declared and paid. 9 moe meo —_ Prepare journal entries to record each of the 2003 transactions. Set up T-accounts with the proper balances at January 1, 2003, and post the journal entries to the T-accounts. 3. Prepare an income statement for the year ended December 31, 2003, and a balance sheet as of that date. Also prepare a statement of retained earnings. 4, Prepare the entries necessary to close the nominal accounts, including Dividends. 5. Post the closing entries to the ledger accounts [label (i) and (j)] and prepare a post-closing trial balance at December 31, 2003.

Step by Step Answer:

Financial Accounting

ISBN: 9780324066708

8th Edition

Authors: W. Steven Albrecht, James D. Stice, Earl Kay Stice, K. Fred Skousen, Albrecht S.E.