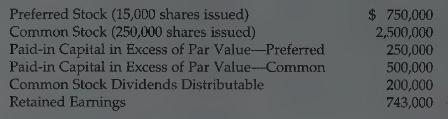

The post-closing trial balance of Maggio Corporation at December 31, 1996, contains the following stockholders' equity accounts:

Question:

The post-closing trial balance of Maggio Corporation at December 31, 1996, contains the following stockholders' equity accounts:

A review of the accounting records reveals the following:

1. No errors have been made in recording 1996 transactions or in preparing the closing entry for net income.

2. Preferred stock is \(\$ 50\) par, \(10 \%\), and cumulative. 15,000 shares have been outstanding since January 1, 1995 .

3. Authorized stock is 20,000 shares of preferred, 500,000 shares of common with a \(\$ 10\) par value.

4. The January 1 balance in Retained Earnings was \(\$ 920,000\).

5. On July \(1,20,000\) shares of common stock were sold for cash at \(\$ 16\) per share.

6. On September 1, the company discovered an understatement error of \(\$ 60,000\) in computing depreciation in 1995 . The net of tax effect of \(\$ 42,000\) was properly debited directly to Retained Earnings.

7. A cash dividend of \(\$ 250,000\) was declared and properly allocated to preferred and common stock on October 1. No dividends were paid to preferred stockholders in 1995 . \(\square\)

8. On December 31 , an \(8 \%\) common stock dividend was declared out of retained earnings on common stock when the market price per share was \(\$ 16\).

9. Net income for the year was \(\$ 435,000\).

10. On December 31, 1996, the directors authorized disclosure of a \(\$ 200,000\) restriction of retained earnings for plant expansion. (Use Note X.)

\section*{Instructions}

(a) Reproduce the retained earnings account for the year.

(b) Prepare a retained earnings statement for the year.

(c) Prepare a stockholders' equity section at December 31.

Step by Step Answer:

Financial Accounting

ISBN: 9780471169208

2nd Edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso