The Second Cup Ltd. is one of Canadas best-known specialty coffee caf franchisors. Exhibits 9.10A to 9.10C

Question:

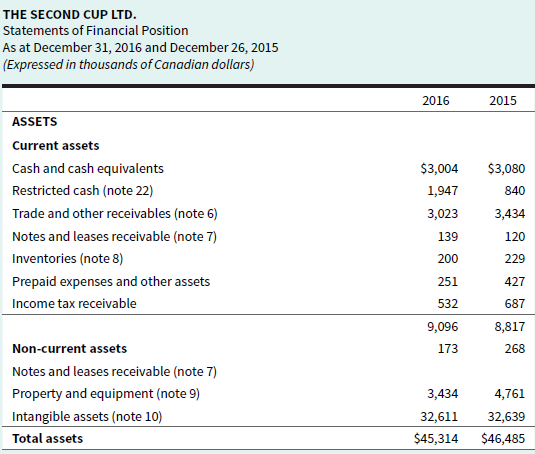

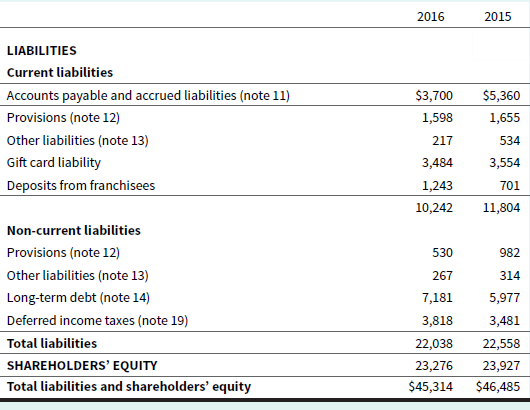

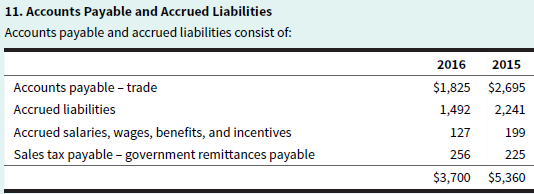

The Second Cup Ltd. is one of Canada’s best-known specialty coffee café franchisors. Exhibits 9.10A to 9.10C contain Second Cup’s statements of financial position, Note 11 detailing accounts payable and accrued liabilities, and Note 2(m) regarding gift card liability.

EXHIBIT 9.10A The Second Cup Ltd.’s 2016 Statements of Financial Position

EXHIBIT 9.10B Excerpt from the Second Cup Ltd.’s 2016 Annual Report, Note 11

EXHIBIT 9.10C Excerpt from the Second Cup Ltd.’s 2016 Annual Report, Note 2(m)

m. Gift card liability

The gift card program allows customers to prepay for future purchases by loading a dollar value onto their gift cards through cash or credit/debit cards in the cafés or online through credit cards, when and as needed. The gift card liability represents liabilities related to unused balances on the card net of estimated breakage. These balances are included as sales from franchised cafés, or as revenue of Company-operated cafés, at the time the customer redeems the amount in a café for products. Gift cards do not have an expiration date and outstanding unused balances are not depleted. When it is determined the likelihood of the remaining balance of a gift card being redeemed by the customer is remote, the amount is recorded as breakage. The determination of the gift card breakage rate is based upon Company-specific historical load and redemption patterns. The 2016 analysis determined that a breakage rate of 3% was applicable to gift card sales, which is consistent with 2015 experience. Gift card breakage is recognized on a pro rata basis based on historical gift card redemption patterns. Breakage income is fully allocated to the Co-op Fund and not recorded in earnings.

Required

a. Calculate the current ratio for 2016 and 2015. Comment on the company’s ability to meet its current liabilities. Has it improved over the prior year?

b. Calculate the accounts payable turnover ratio and accounts payable payment period. Second Cup’s cost of goods sold was $5,795 thousand for its 2016 fi scal year. Comment on these ratios.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley