Thorsby Construction Ltd. (Thorsby) recently received a contract to do long-needed repairs on the major bridges leading

Question:

Thorsby Construction Ltd. (Thorsby) recently received a contract to do long-needed repairs on the major bridges leading to a large city. The bridges have stress fractures and other evidence of deterioration and the municipal and provincial government agreed to jointly finance repairs. The repairs to all the bridges are expected to take three years. Thorsby will receive $15 million in total for the work. A payment of $3 million will be made when the contract is signed on July 15, 2014 and

$3.8 million on June 1, 2015. Thorsby will receive $6 million when the work is complete, expected to be in May 2016. A final payment of $2.2 million is to be made 90 days after the repairs are complete. Thorsby’s year-end is July 31.

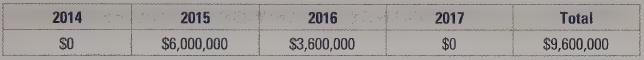

Thorsby expects to incur the following costs during each fiscal year for the work:

In addition, Thorsby expects to incur $1,200,000 in each of fiscal 2015 and 2016.

These costs will be treated as period costs in the calculation of income.

Required

a. Calculate revenue, expenses, gross margin, and net income for each year using the following revenue recognition methods:

i. Percentage-of-completion ii. Zero-profit iii. Cash collection (Match construction costs based on the proportion of cash collected in each year.)

b. Calculate the gross margin percentage and the profit margin percentage for each year.

c. Does it matter how Thorsby accounts for its revenue from the refitting contract?

To whom does it matter and why?

d. Is the actual economic performance of Thorsby affected by how it accounts for the revenue from the refitting contract? Explain.

Step by Step Answer: