(Transfer prices; regular use of direct method of allocation from Chapter 5) Williams & Associates, CPAs, has...

Question:

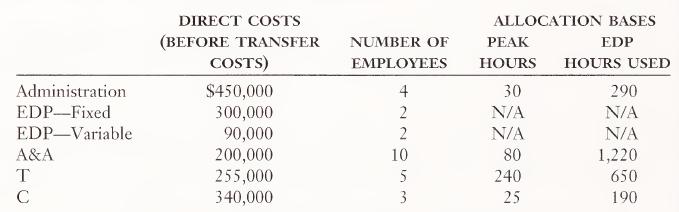

(Transfer prices; regular use of direct method of allocation from Chapter 5) Williams & Associates, CPAs, has three revenue departments: Auditing and Accounting (A&A), Tax (T), and Consulting (C). In addition, the company has two support departments: Administration and EDP. Administration costs are allocated to the three revenue departments on the basis of number of employees. The EDP department’s fixed costs are allocated to revenue departments on the basis of peak hours of monthly service expected to be used by each revenue department. EDP’s variable costs are assigned to the revenue departments at a transfer price of $40 per hour of actual service. Following are the direct costs and the allocation bases associated with each of the departments:

a. Was the variable EDP transfer price of $40 adequate? Explain.

b. Allocate the other service department costs to A&A, T, and C using the direct method. (See Chapter 5 for the direct method of allocation.)

c. What are the total costs of the revenue-producing departments after allocation?

Step by Step Answer: