(Transfer pricing and decision making) The Controls Division of Johnson Electric Motors manufactures a starter with the...

Question:

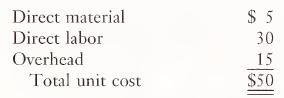

(Transfer pricing and decision making) The Controls Division of Johnson Electric Motors manufactures a starter with the following standard costs:

The standard direct labor rate is $15 per hour, and overhead is assigned at 50 percent of the direct labor rate. Normal capacity direct labor hours are 20,000, and the overhead rate is $2.50 variable and $5.00 fixed per direct labor hour based on normal capacity.

The starters sell for $75, and the Controls Division is currently operating at a level of 16,000 direct labor hours for the year. All transfers in Johnson are made at market price. If mutually agreed upon, the divisional managers are per¬ mitted to negotiate a transfer price.

The Motor Division currently purchases 2,000 starters from the Controls Division at market price. The divisional manager of the Motor Division indicates that she can purchase the starters from a foreign supplier for $65. Because she is free to select a supplier, she has indicated that she would like to negotiate a new transfer price with the Controls Division. The managers of the Controls Division indicate that they believe the foreign supplier is attempting to “buy in” by selling the starters at what they consider to be an excessively low price,

a. From the perspective of the firm, should the Motors division purchase the starters internally or externally? How much will the firm’s pretax income change if the starters are purchased from the foreign supplier?

CHAPTER 19 Responsibility Accounting and Transfer Pricing in Decentralized Organizations 915

b. From the view of the Motor Division, should the starters be purchased from the Controls Division or the foreign supplier? How much will the pretax income of the division change if the starters are purchased from the foreign supplier?

c. From the perspective of the Controls Division, how much will its net income change if the starters are purchased from the foreign supplier? What is the minimum price at which the Controls Division would transfer the starters? What is the change in the pretax income of the Controls Division if the transfers are made at $65 a unit?

d. If the Controls Division were operating at 100 percent of capacity and the Motor Division wanted to purchase the starters externally, from the point of view of the firm, the Motor Division, and the Controls Division, what should be done if (1) The Controls Division could not sell the additional starters externally to continue operating at full capacity?

(2) The Controls Division could sell the additional starters externally to continue at full capacity?

Step by Step Answer: