(Understanding the effect of different estimates on net income, LO 4) In 2005 Otis Knight opened a...

Question:

(Understanding the effect of different estimates on net income, LO 4) In 2005 Otis Knight opened a small business that he called The Gorner Coffee Cart. The Corner Coffee Cart sells a variety of coffee-based beverages from a portable cart that Otis can move from place to place. Otis purchased the cart for $12,000 cash when he began the business. All of The Corner Coffee Cart’s transactions are for cash. Otis pays cash for all supplies and all sales to customers are for cash. At the end of 2005 Otis decided he wanted to get an idea about how well The Corner Coffee Cart per- formed in its first year. He assembled the following information:

i. Sales to customers $22,000 (all in cash)

ii. Cost of providing coffee to customers $13,000 (all in cash, includes coffee, milk, cups, stir sticks, etc.)

From this information Otis concluded that he had made $9,000, which he was satis- fied with. A friend who had recently taken an accounting course told Otis that his

profit of $9,000 was not correct because he did not amortize the cost of the coffee cart. Otis asked his friend to help him calculate the “correct” amount of profit based on the friend’s knowledge of accounting.

Required:

a. Why did Otis’s friend tell Otis that his measure of profit was not correct without an amortization expense for the cart? Do you agree with the friend’s position?

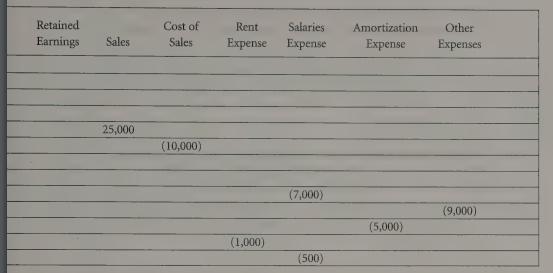

b. If Otis assumes that the useful life of the cart is six years and he amortizes the cost of the cart using the straight-line method (an equal amount is expensed each year), what would The Corner Coffee Cart’s net income for 2005 be?

Assume that the cart would not have any value at the end of its life.

c. Calculate The Corner Coffee Cart’s net income assuming that the cost of the cart is amortized over three years. Calculate net income assuming the cost of the cart is amortized over ten years.

d. What is the difference in The Corner Coffee Cart’s net income using the three different periods for amortizing the cart in

(b) and (c)?

. How is your evaluation of how The Corner Coffee Cart performed during 2005 affected by using different periods for amortizing the cart?

Assume that the different periods used for amortizing the cart simply represent different reasonable estimates of the cart’s useful life. Is the actual performance of The Corner Coffee Cart really different even though the net income under each estimate is different? Explain.

. What is the “correct” number of years over which to amortize the cart?

Step by Step Answer: