Question: 10. In security analysis, the returns on a share are related to the returns on the market portfolio to calculate the beta of that security.

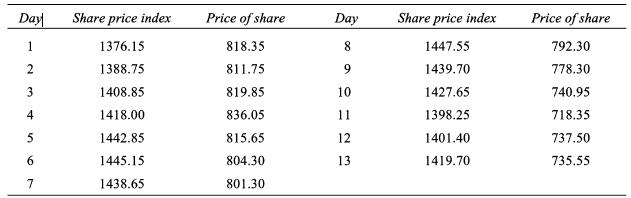

10. In security analysis, the returns on a share are related to the returns on the market portfolio to calculate the beta of that security. For a share the return is usually calculated as (P1-P1_ 1)/P1_ 1, where P1is the current day's closing price while P1_ 1 is the closing price of the previous day. The return on market portfolio is taken as the return on share price index. The return on index is calculated in the same way as return on a share. This is equal to(/ -/1_ 1)/11_ 1• Each of these may be expressed as percentages as well. For a given share, the prices are observed for 13 days and are recorded below along with the index values on those days.

You are required to regress the returns on the share on the returns on the index. What does the beta, the regression coefficient indicate? Now, estimate the return on this share if the market were to increase by 12%.

Day Share price index Price of share Day Share price index Price of share 1 1376.15 818.35 8 1447.55 792.30 2 1388.75 811.75 9 1439.70 778.30 3 1408.85 819.85 10 1427.65 740.95 4 1418.00 836.05 11 1398.25 718.35 5 1442.85 815.65 12 1401.40 737.50 6 1445.15 804.30 13 1419.70 735.55 7 1438.65 801.30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts