18. A firm is faced with a short-term cash flow problem, which would necessitate obtaining a loan...

Question:

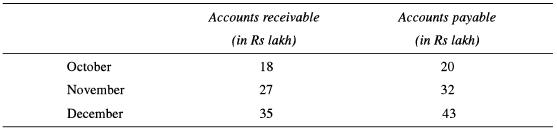

18. A firm is faced with a short-term cash flow problem, which would necessitate obtaining a loan from its bank. The bank loan will be used to balance the cash inflows from accounts receivable and cash outflows from accounts payable, which are estimated as follows:

It may be assumed that both accounts receivable and accounts payable are due at the end of the relevant month and that all accounts payable are to be settled by the end of the year (December). While in any month funds from accounts receivable would flow at a time such that sufficient time would be available to finance firm's own payments of the months, in October and November, the payments to be made to the suppliers could be delayed by at the most one month. However, the delay in the payments would make the firm lose the 2 per cent discount receivable for making payment within one month.

Information about the bank loan is as follows:

(i) Any amount of loan may be taken by the firm but a loan be agreed at the start of a given month.

(ii) The loan would carry an interest rate at the rate of 2.5 per cent per month and attract a minimum of one month's interest.

Further, any surplus cash may be invested with the bank, which would earn an interest 1 per cent per month.

Using the above information, formulate the problem as a transportation problem by appropriately defining the costs and flows. Also determine the optimal solution to the problem.

Step by Step Answer: