22. M.C. Company is evaluating an investment proposal that has uncertainty associated with the three important aspects:

Question:

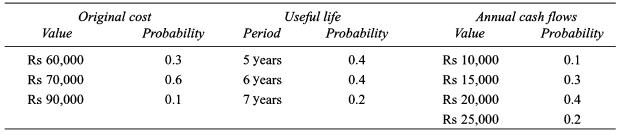

22. M.C. Company is evaluating an investment proposal that has uncertainty associated with the three important aspects: the original cost, the useful life and the annual net cash flows. The three probability distributions for these variables are as shown below:

The firm wants to perform five simulation runs of this project's life. The firm's cost of capital is 15 per cent and the risk-free rate is 6 per cent. For simplicity, it is assumed that these two values are known for certain, and will remain constant over the life of the project.

To simulate the probability distributions of the original cost, the useful life and the annual net cash flows, use the following sets ofrandom numbers: 09, 84, 41, 92, 65; 24, 38, 73, 07, 04; 07, 48, 57, 64, 72 respectively. Determine the NPV and the payback period for each of the five simulation runs.

Step by Step Answer: