7. A Mutual Fund company has Rs 20 lakhs available for investment in Government bonds, blue chip...

Question:

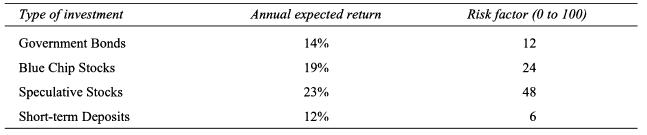

7. A Mutual Fund company has Rs 20 lakhs available for investment in Government bonds, blue chip stocks, speculative stocks and short-term bank deposits. The annual expected return and risk factors are given as follows:

Mutual Fund is required to keep at least Rs 2 lakhs in short-term deposits and not to exceed an average risk factor of 42. Speculative stocks must be at most 20 percent of the total amount invested. How should Mutual Fund invest the funds so as to maximise its total expected annual return? Formulate this as a Linear Programming Problem. Do not solve it.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: