A leading Chartered Accountant is attempting to determine a best investment portfolio and is considering six alternative

Question:

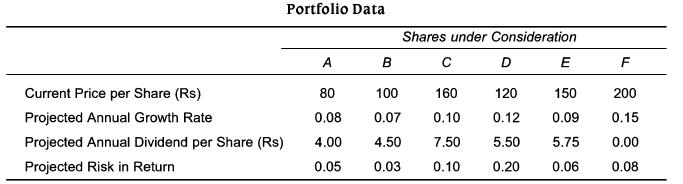

A leading Chartered Accountant is attempting to determine a "best" investment portfolio and is considering six alternative investment proposals. The following table indicates point estimates for the price per share, the annual growth rate in the price per share, the annual dividend per share and a measure of the risk associated with each investment.

The total amount available for investment is Rs 25 lakhs and the following conditions are required to be satisfied.

(i) The maximum rupee amount to be invested in alternative F is Rs 250,000.

(ii) No more than Rs 500,000 should be invested in alternatives A and B combined.

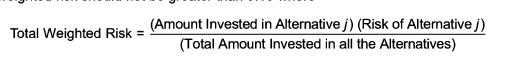

(iii) Total weighted risk should not be greater than 0.10 where

(iv) For the sake of diversity, at least 100 shares of each stock should be purchased.

(v) At least 10 percent of the total investment should be in alternatives A and B combined.

(vi) Dividends for the year should be at least Rs 10,000.

Rupee return per share of stock is defined as price per share one year hence Jess current price per share plus dividend per share. If the objective is to maximise total rupee return, formulate the linear programming model for determining the optimal number of shares to be purchased in each of the shares under consideration. You may assume that the time horizon for the investment is one year. The formulated LP problem is not required to be solved.

Step by Step Answer: