Analyze the cost of renting, leasing, and purchasing a backhoe loader using the data given below. Evaluate

Question:

Analyze the cost of renting, leasing, and purchasing a backhoe loader using the data given below. Evaluate after-tax cash flow and its present value.

Basic assumptions:

Marginal tax rate = 46%

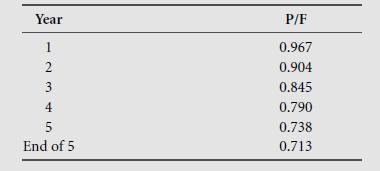

After-tax rate of return = 7%

Planned equipment use = 2000 h/year for 5 years Present value factors (i = 7%)

Purchase assumptions:

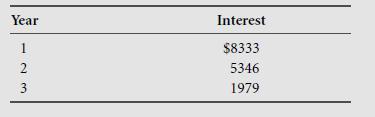

Cost = $100,000 Estimated resale value after 5 years = $40,000 Cost recovery method = 5-year MACRS Down payment = $20,000 Loan terms = $80,000, 12%, 36 months = $2,657.20/month Interest payments:

Lease assumptions:

Term of lease = 5 years Lease payments = $1850/month Initial payment = 3 months in advance Rental assumptions:

Rental period = 5 years, month to month Rental rate = $3375/month

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: