Consider the accounts receivable problem of a firm. Suppose that, for this firm, an accounts receivable turns

Question:

Consider the accounts receivable problem of a firm. Suppose that, for this firm, an accounts receivable turns into bad debt if the account is more than three months overdue. Now, at the beginning of each month, each of the accounts may be classified into one of the following states:

State 1 : New account State 2 : Account is one month overdue for payment State 3 : Account is two months overdue for payment State 4 : Account is three months overdue for payment State 5 : Account has been paid State 6 : Account is written off as bad debt.

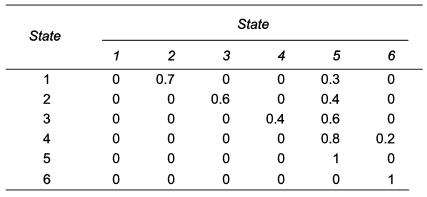

Suppose further that on the basis of the past data, the following transition matrix, indicating how the status of an account changes from one month to the next, has been derived:

The various entries in the matrix can be interpreted in the usual way. For example, the probability of a new account to be paid by the beginning of the next month is 30% while the probability of it being not paid and, therefore, become a one-month overdue is 70%; and if an account is two months overdue at the beginning of a month, there is a 40% chance that at the beginning of the next month the account shall not be paid up and hence be three months overdue, and a 60% chance that the account would be paid up. It is assumed for simplicity that after the three-months period, an account is either paid up or is written off as bad debt. Thus, if and when an account is paid up or written off as bad debt, the account gets closed and no more transitions can occur. States 5 and 6, account paid up and account written off, respectively, are therefore, the absorbing states-every new account shall eventually be absorbed as either a paid up debt or a bad debt. The other states, 1 through 4, are transient states.

The questions that we seek to answer include the following:

(i) What is the probability that a new account shall eventually be collected?

(ii) What is the probability that a new account shall be written off as bad debt?

(iii) What is the probability that an account which is one-month overdue shall eventually be a bad debt?

(iv) What is the probability that a two-month overdue account shall finally be collected?

(v) If the firm makes a credit sales of Rs 400,000 per month, on the average, what amount can it expect to lose per annum by way of bad debts?

Step by Step Answer: