Given the following CME Eurodollar futures call options: June Eurodollar futures call with exercise price of 93

Question:

Given the following CME Eurodollar futures call options:

June Eurodollar futures call with exercise price of 93 (IMM index) selling at 2.

September Eurodollar futures call with exercise price of 93 (IMM index)

selling at 2.1.

December Eurodollar futures call with exercise price of 93 (IMM index)

selling at 2.2.

a. Explain how XSIF Trust in Question 8 could attain a floor on its floatingrate note with the options. What is the cost of the options?

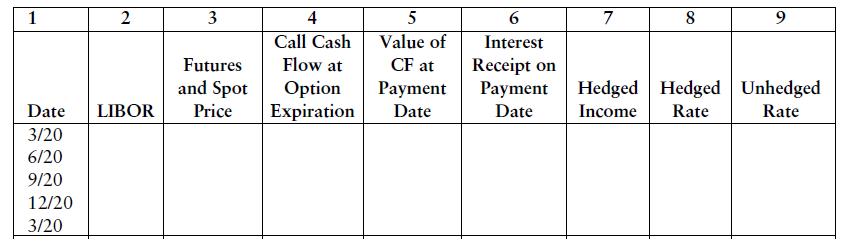

b. Show in the table below XSIF’s quarterly interest receipts, option cash flow, hedged interest revenue (interest plus option cash flow), and hedged rate as a proportion of a $10 million investment (do not include option cost) for each period given the following rates: LIBOR = 7.5% on 3/20, 7% on 6/20, 6.5% on 9/20, and 6% on 12/20. Assume the interest reset dates and option expiration dates coincide.

Step by Step Answer: