Suppose Bryce National Bank in Question 3 makes a $10 million, 180-day loan to Midwest Mining Company

Question:

Suppose Bryce National Bank in Question 3 makes a $10 million, 180-day loan to Midwest Mining Company with the loan financed by selling a 90-day CD now at the prevailing LIBOR of 8.25% and then 90 days later (mid-September)

selling another 90-day CD at the prevailing LIBOR. Suppose, though, the bank would like to minimize its exposure to interest rate risk on its future CD sale but would also like to benefit if CD rates decrease. Suppose there is a September Eurodollar futures put with an exercise price of 92 trading on the CME at 2.

a. How many September Eurodollar futures puts would Bryce National Bank need in order to effectively hedge its September CD sale against interest rate changes? Assume perfect divisibility.

b. Assume that the Eurodollar futures are closed at the LIBOR and the Eurodollar futures and futures options expire at the same time as the Bank’s first CD.

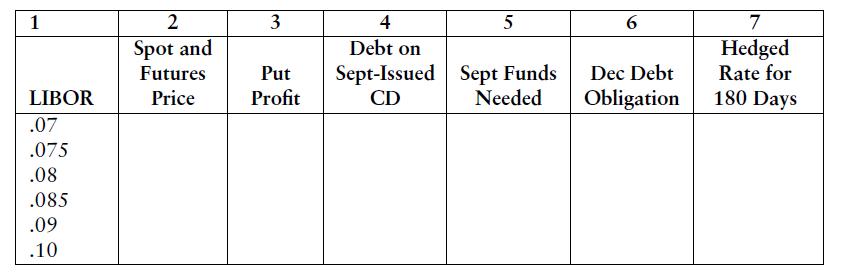

Using the table below, determine the total amount of funds the bank would need to raise on its September CD, the bank’s debt obligations at the end of the 180-day period, and the bank’s hedged rates for the entire 180-day period given the following LIBORs at the options and first CD maturity date: 7%, 7.5%, 8%, 8.5%, 9%, 9.5%, and 10%.

Step by Step Answer: