Suppose on March 1 you take a long position in a June T-bill futures contract at RD

Question:

Suppose on March 1 you take a long position in a June T-bill futures contract at RD = 5%.

a. How much cash or risk-free securities would you have to deposit to satisfy an initial margin requirement of 5%?

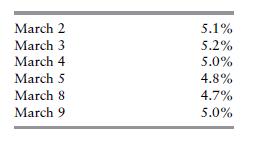

b. Calculate the values of your equity account on the following days, given the following discount yields:

c. If the maintenance margin requirement specifies keeping the value of the equity account equal to 100% of the initial margin requirement each day, how much cash would you need to deposit in your commodity account each day?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: