Suppose the Kendall Money Market Fund in Question 1 expects interest rates to be higher in September

Question:

Suppose the Kendall Money Market Fund in Question 1 expects interest rates to be higher in September when it plans to invest its $18 million cash flow in 91-day T-bills, but is worried that rates could decrease. Suppose there is a September T-bill futures call contract with an exercise price of 93 (IMM index), trading at 5, and expiring at the same time as the September T-Bill futures contract.

a. How many September T-bill futures call options does Kendall need in order to lock in a minimum rate on its investments (do not assume perfect divisibility)?

What is the cost?

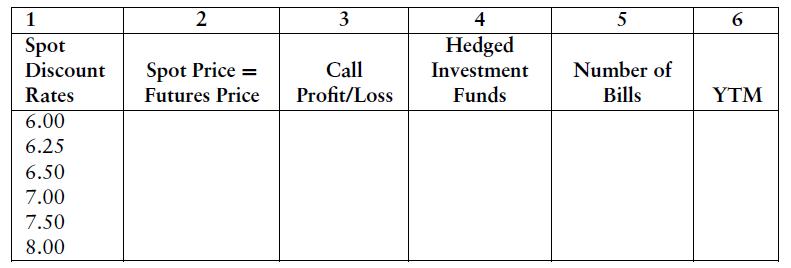

b. Assuming the fund’s $18 million cash inflow comes at the same time as the September T-bill futures call contract expires, use the table below to determine the fund’s option-hedged T-bill yield for possible spot discount rates, at the option’s expiration date, of 6%, 6.25%, 6.5%, 7%, 7.5%, and 8%.

Step by Step Answer: