The Fort Washington Money Market Fund expects interest rates to be higher in September when it plans

Question:

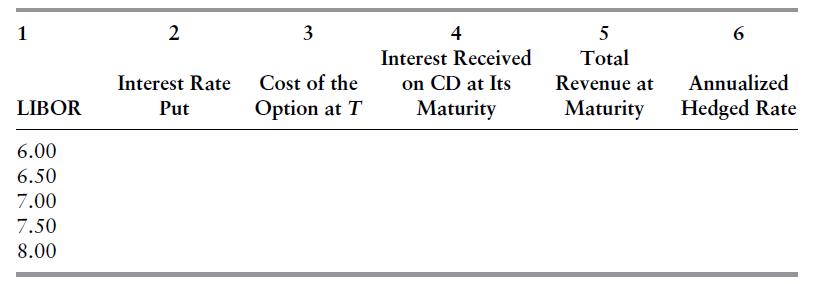

The Fort Washington Money Market Fund expects interest rates to be higher in September when it plans to invest its $18 million cash flow in a 90-day CD offered by Sun Bank paying the LIBOR. Suppose the fund decides to hedge the September investment by buying an interest rate put from Provident bank. The floorlet has the following terms:

Exercise rate of 7%

Payoff at the maturity of the CD

Reference rate of LIBOR

Time period of 90 days (.25)

Notional principal of $18 million

Expiration at the time of the September cash flow investment

Cost of floorlet is $100,000, payable at the expiration Using the table below, determine the fund’s hedged yield for possible spot LIBORs at the option’s expiration date of 6%, 6.5%, 7%, 7.5%, and 8%.

Step by Step Answer: