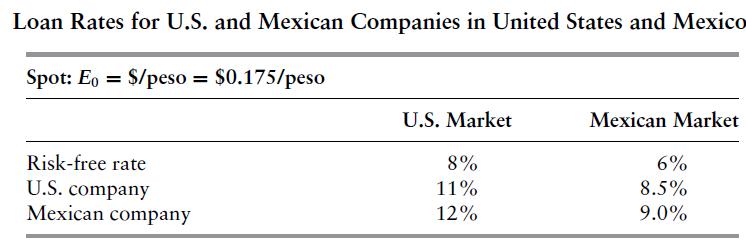

The table shows the annual loan rates U.S. and Mexican companies can each obtain on a five-year,

Question:

The table shows the annual loan rates U.S. and Mexican companies can each obtain on a five-year, $20 million loan in the United States and/or equivalently on a five-year 114.2857 million peso loan in the Mexican market.

a. Explain the comparative advantages that exist for the U.S. and Mexican companies.

b. Suppose the U.S. company wants to borrow 114.2857 million pesos for five years to finance its Mexican operations, while the Mexican company wants to borrow $20 million for five years to finance its U.S. operations.

Explain how a swap bank could arrange a currency swap that would benefit the U.S. company by lowering its peso loan by .25% and would benefit the Mexican company by lowering its dollar loan by .1%. Show the initial cash flow, interest rate, and principal swap arrangements in a diagram.

c. Describe how the swap bank’s position is similar to a series of peso forward contracts.

d. What would the bank’s dollar position be if it hedged the swap position using the forward market at forward rates determined by the IRPT and at the risk-free rates shown in the table? Assume a flat yield curve. Determine the swap bank’s profit from its swap position and forward exchange rate position.

Step by Step Answer: