XU Trust is planning to invest $15 million in a Commerce Bank one-year floating-rate note paying LIBOR

Question:

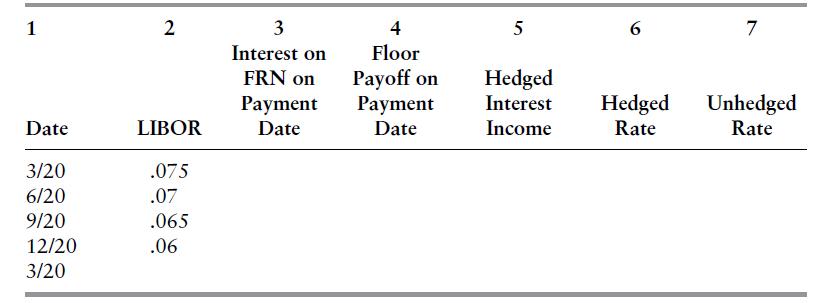

XU Trust is planning to invest $15 million in a Commerce Bank one-year floating-rate note paying LIBOR plus 150 basis points. The investment starts on 3/20 at 9% (when the LIBOR = 7.5%) and is then reset the next three quarters on 6/20, 9/20, and 12/20. XU Trust would like to establish a floor on the rates it obtains on the note. A money center bank is offering XU a floor for

$100,000 with the following terms corresponding to the floating-rate note:

The floor consists of three floorlets coinciding with the reset dates on the note

Exercise rate on the floorlets = 7%

Notional principal = $15 million

Reference rate = LIBOR

Time period on the payoffs is .25

Payoff is paid on the payment date on the note

Cost of the floor is $100,000 and is paid on 3/20 Calculate and show in the table below XU Trust’s quarterly interest receipts, floorlet cash flow, hedged interest revenue (interest plus floorlet cash flow), and hedged rate as a proportion of the $15 million investment (do not include floor cost) given the LIBORs shown in the table.

Step by Step Answer: