A European cancelable swap allows the owner to cancel a swap at some point before the swap

Question:

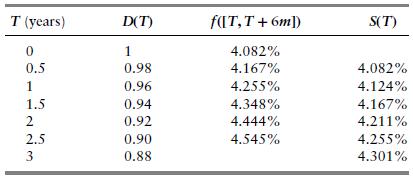

A European cancelable swap allows the owner to cancel a swap at some point before the swap maturity. The cancellation option is economically equivalent to a European swaption into an offsetting remaining swap, and the value of the cancelable swap is a swap plus the cancellation option. Using DFs in Table 7.3, and 1 year into 2-year swaption volatility \(\sigma_{N}=1.20 \%\), consider a 3 -year swap with semiannual fixed rate of \(K\) per annum.

(a) Solve for \(K\) so that today's value of the swap is 0 , that is, the 3 -year semiannual par swap rate.

(b) The fixed rate payer in the above swap has the option to cancel the swap in 1 year. The cancellation option is economically equivalent to a 1 year into 2 -year receiver swaption with strike \(K\). Solve for \(K\) that would make today's value of the cancelable swap 0 . Is \(K\) above or below the 3-year par swap rate?

(c) The fixed-rate receiver in the above swap has the option to cancel the swap in 1 year. The cancellation option is economically equivalent to a 1 year into 2 -year payer swaption with strike \(K\). Solve for \(K\) that would make today's value of the cancelable swap 0 . Is \(K\) above or below the 3-year par swap rate?

Step by Step Answer:

Mathematical Techniques In Finance An Introduction Wiley Finance

ISBN: 9781119838401

1st Edition

Authors: Amir Sadr