Study the Employee Earnings Record for Jason C. Jenkins in Exhibit 11-10, page 639 . In addition

Question:

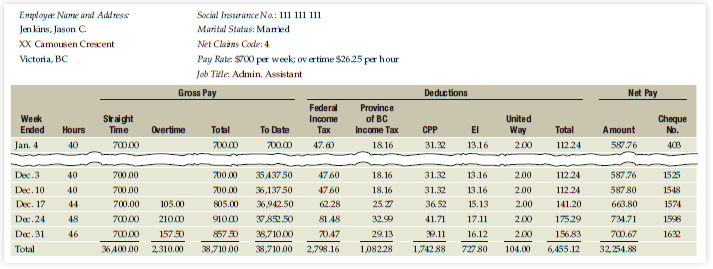

Study the Employee Earnings Record for Jason C. Jenkins in Exhibit 11-10, page 639 . In addition to the amounts shown in the exhibit, the employer also paid all employee benefits plus (a) an amount equal to 5 percent of gross pay into Jenkins's pension retirement account, and (b) dental insurance for Jenkins at a cost of $35 per month and parking of $10 per month. Compute the employer's total payroll expense for employee Jason C. Jenkins during 2015. Carry all amounts to the nearest cent.

Exhibit 11-10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Horngrens Accounting Volume 1

ISBN: 9780135359709

11th Canadian Edition

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol Meissner, JoAnn Johnston, Peter Norwood

Question Posted: