Superstar Ice Rinks Inc. (SIR) is a privately owned company owned by a group of investors headed

Question:

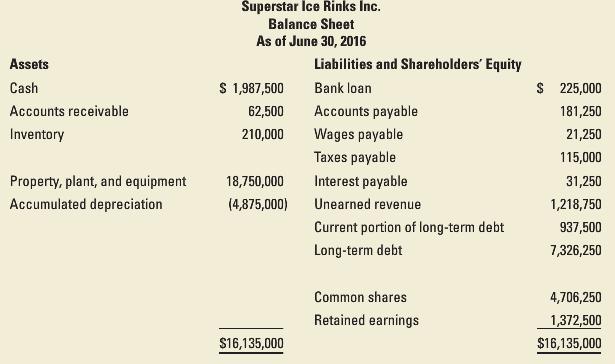

Superstar Ice Rinks Inc. (SIR) is a privately owned company owned by a group of investors headed by James T. Kirk, a retired professional hockey player. SIR owns three arenas in suburban areas near a large Canadian city, which it rents out to hockey leagues and individuals for recreational use. SIR's arenas also have a pro shop and food and beverage service. SIR's balance sheet for June 30, 2016, the company's year-end, follows. SIR uses its financial statements for tax purposes, to show to the holders of the long-term debt that was used to finance the purchase of the arenas, and for the shareholders, particularly those who aren't involved in management.

It's now July 2017. SIR needs to prepare its financial statements for the year ended June 30, 2017. You have obtained the following information about the fiscal year just ended:

i. During fiscal 2017, SIR purchased an existing arena for $4,750,000. The purchase was financed by $1,875,000 of new long-term debt, SIR shares worth $1,253,000 given to the previous owners of the arena, and the remainder in cash.

ii. During fiscal 2017, SIR earned $5,820,000 in revenue from renting ice. In addition, the pro shop and restaurant earned $1,725,000 in revenue. Of these amounts, $625,000 was on credit provided by SIR. During the year, $614,000 was collected from customers who purchased on credit.

iii. Leagues renting ice time for the entire season are required to pay a deposit in May.

The deposit is then recognized as revenue over the year as the ice is used by the league. In May 2017, SIR collected $1,310,000 in deposits from leagues. Deposits are for leagues that play from September through April.

iv. SIR has a $250,000 line of credit from a local bank. A line of credit means SIR can borrow up to $250,000 without additional approval from the bank.

v. During the year, SIR paid employees $1,062,000 in cash, including the amount owing at the end of fiscal 2016. During the year employees earned $1,076,000.

vi. During fiscal 2017, SIR repaid $937,500 of its long-term debt. Next year, SIR must repay $1,125,000 of the debt.

vii. During fiscal 2017, SIR paid lenders $563,000 in interest, including interest owed at the end of the previous year. No interest is lowing at the end of fiscal 2017.

viii. During the year, SIR purchased goods for sale in the pro shops and restaurants for

$756,000, all purchased on credit. Suppliers were paid $750,000 during the year.

ix. SIR purchased other goods and services (fuel for the Zamboni, utilities, maintenance, etc.) during the year, costing $1,969,000, also on credit. These creditors received payments of $1,938,000 during the year.

x. The products sold in the pro shops and food and drink sold in the restaurants during the year cost $765,000.

xi. SIR incurred additional expenses during the year that cost $375,000 and were paid for in cash.

xii. During the year, SIR paid the taxes it owed at the end of fiscal 2016. It also paid $64,000 in instalments on its 2017 income taxes. SIR estimates that it owes an additional $42,000 in income taxes for 2017.

xiii. Depreciation for the year was $1,563,000.

xiv. During the year, SIR traded ice time with a market value of $26,000 for services worth the same amount.

Required:

a. Enter each of the transactions onto an accounting equation spreadsheet. You can use a computer spreadsheet program or create a spreadsheet manually. Create a separate column on the spreadsheet for each account. Make sure you prepare all adjusting entries and the closing entry. Indicate whether each entry is a transactional entry, an adjusting entry, or a closing entry.

b. Provide explanations for each of your entries. You should explain why you have treated the economic events as you have (that is, why you have recorded an asset, liability, etc.).

c. Prepare a balance sheet as of June 30, 2017 and an income statement for the year ended June 30, 2017 from your spreadsheet.

d. SIR's non-management shareholders have asked you to analyze the company's financial position and performance. Write a report analyzing the information you prepared.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Line of Credit

A line of credit (LOC) is a preset borrowing limit that can be used at any time. The borrower can take money out as needed until the limit is reached, and as money is repaid, it can be borrowed again in the case of an open line of credit. A LOC is...

Step by Step Answer: