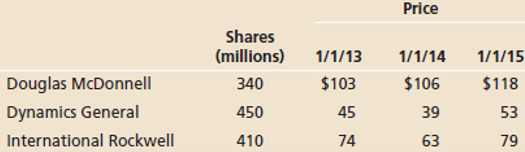

Suppose the following three defense stocks are to be combined into a stock index in January 2013

Question:

Suppose the following three defense stocks are to be combined into a stock index in January 2013 (perhaps a portfolio manager believes these stocks are an appropriate benchmark for his or her performance):

a. Calculate the initial value of the index if a price-weighting scheme is used.

b. What is the rate of return on this index for the year ending December 31, 2013? For the year ending December 31, 2014?

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments Valuation and Management

ISBN: 978-0078115660

7th edition

Authors: Bradford Jordan, Thomas Miller

Question Posted: