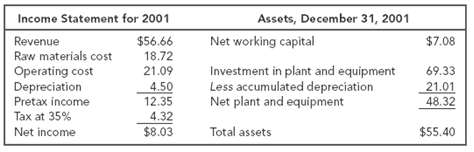

Question: Table 12.10 shows a condensed income statement and balance sheet for Androscoggin Copper?s Rumford smelting plant. a. Calculate the plant?s EVA. Assume the cost of

Table 12.10 shows a condensed income statement and balance sheet for Androscoggin Copper?s Rumford smelting plant.

a. Calculate the plant?s EVA. Assume the cost of capital is 9 percent.

b. As Table 12.10 shows, the plant is carried on Androscoggin?s books at $48.32 million. However, it is a modern design, and could be sold to another copper company for $95 million. How should this fact change your calculation of EVA?

Assets, December 31, 2001 Net working capital Income Statement for 2001 Revenue Raw materials cost Operating cost Depreciation Pretax income $56.66 18.72 21.09 4.50 12.35 4.32 $8.03 $7.08 Investment in plant and equipment Less accumulated depreciation Net plant and equipment 69.33 21.01 48.32 Tax at 35% Net income Total assets $55.40

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

a EVA Income earned Cost of capital x Invest... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-C-B (156).docx

120 KBs Word File