Tetra Company's cost system assigns MSDA expenses to customers using a rate of 33% of sales revenue.

Question:

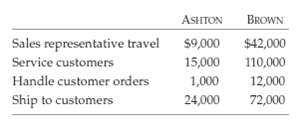

Tetra Company's cost system assigns MSDA expenses to customers using a rate of 33% of sales revenue. The new controller has discovered that Tetra's customers differ greatly in their ordering patterns and interaction with Tetra's sales force. Because the controller believes Tetra's cost system does not accurately assign MSDA expenses to customers, she developed an activity-based costing system to assign these expenses to customers. She then identified the following MSDA costs for two customers, Ashton and Brown:

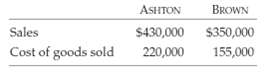

The following additional information is available:

Required(a) Using the current cost system's approach of assigning MSDA expenses to customers using a rate of 33% of sales revenue, determine the operating profit associated with Ashton and with Brown.(b) Using the activity-based costing information provided, determine the operating profit associated with Ashton and with Brown.(c) Which of the two methods produces more accurate assignments of MSDA expenses to customers? Explain.

Step by Step Answer:

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young