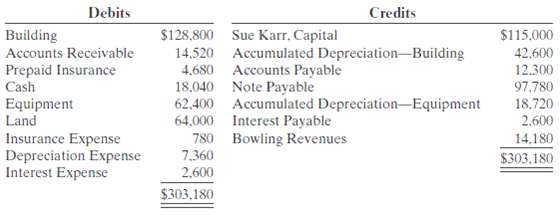

The adjusted trial balance for Karr Bowling Alley at December 31, 2010, contains the following accounts. Instructions(a)

Question:

The adjusted trial balance for Karr Bowling Alley at December 31, 2010, contains the following accounts.

Instructions(a) Prepare a classified balance sheet; assume that $13,900 of the note payable will be paid in 2011.(b) Comment on the liquidity of thecompany.

Debits Credits Building Accounts Receivable Prepaid Insurance $128,800 Sue Karr. Capital 14.520 Accumulated Depreciation–Building 4,680 Accounts Payable 18,040 Note Payable 62.400 Accumulated Depreciation-Equipment 64,000 Interest Payable 780 Bowling Revenues $115.000 12.300 Cash Equipment Land Insurance Expense Depreciation Expense Interest Expense 97.780 18.720 2.600 14.180 $303.180 7.360 2,600 $303.180

Step by Step Answer:

a KARR BOWLING ALLEY Balance Sheet December 31 2010 Assets Current assets Cash 18040 Accounts receiv...View the full answer

Accounting Principles

ISBN: 978-0470533475

9th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Accounting questions

-

The adjusted trial balance for Karr Bowling Alley at December 31, 2011, contains the following accounts. Instructions (a) Prepare a classified balance sheet; assume that $13,900 of the note payable...

-

The adjusted trial balance for Rego Bowling Alley at December 31, 2014, contains the following accounts. Instructions (a) Prepare a classified balance sheet; assume that $15,000 of the note payable...

-

The following information is available for Karr Bowling Alley at December 31, 2012. Prepare a classified statement of financial position; assume that $13,900 of the notes payable will be paid in2013....

-

Linking every transport stakeholder together and ensuring seamless travel across Europe is a dream. With this objective, Amadeus, a leading global travel technology player, initiated a novel idea of...

-

At the end of the year, Estes Company provided the following actual information: Overhead........................$412,600 Direct labor cost..................532,000 Estes uses normal costing and...

-

What are the values of A[K] and A[K+1] after code corresponding to the following pseudocode is run? Set A[K] = 10 Set A[K+1] = 20 Set Temp = A[K] Set A[K] = A[K + 1] Set A[K + 1] = Temp Write A[K]...

-

9-5. Why can an insignificant point of difference lead to new-product failure?

-

Multiple Choice Questions 1. United First Bank, the nationwide banking company, owns many types of investments. Assume that United First Bank paid $700,000 for trading securities on December 3. Two...

-

Hemming Company reported the following current - year purchases and sales for its only product. \ table [ [ Date , Activities,Units,Acquired at , Cost,,Units Sold at , Retail ] , [ January 1 ,...

-

How are goals, expectations, and standards connected with one another? How are they connected to Encourage the Heart?

-

Mason Company has an inexperienced accountant. During the first 2 weeks on the job, the accountant made the following errors in journalizing transactions. All entries were posted as made. 1. A...

-

The following are the major balance sheet classifications. Current assets (CA)......... Current liabilities (CL) Long-term investments (LTI)..... Long-term liabilities (LTL) Property, plant, and...

-

Atlanta Company is preparing its manufacturing overhead budget for 2012. Relevant data consist of the following. Units to be produced (by quarters): 10,000, 12,000, 14,000, 16,000. Direct labor: Time...

-

James A. and Ella R. Polk, ages 70 and 65, respectively, are retired physicians who live at 3319 Taylorcrest Street, Houston, Texas 77079. Their three adult children (Benjamin Polk, Michael Polk, and...

-

I need help solving the following question: - Thank you in advance. On January 1, Year 6, HD Lid., a building supply company, JC Lid., a construction company, and Mr. Saeid, a private investor,...

-

Let X 1 , , X n X 1 , , X n be a random sample from a normal distribution with mean and variance 1. Find the uniformly minimum variance unbiased estimator of 2 2 .2 answers

-

The ledger of Duggan Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. Debit Credit Prepaid Insurance $3,600 Supplies...

-

1.Using the Excel file Sales transaction find the following15 Marks a.Identify the levels of measurement for each variables b.Construct a cross tabulation to find the number of transactions by...

-

Gilbert's business sells a fixed asset for cash proceeds of 1300. The asset originally cost 20 700, and accumulated depreciation at the point of sale was 18 210. Three of the following six statements...

-

CLASS PERIO Solving Linear Equations: Variable on Both Sides Solve each equation. 1) 6r+ 7 = 13 + 7r 3) -7x-3x+2=-8x-8 5)-14 +66+7-26=1+5b 7) n-3n = 14-4n 2) 13-4x=1-x 4)-8-x= x - 4x 6)n+2=-14-n 8)...

-

What is wear leveling, and why is it needed for SSDs?

-

The May 21, 2010, edition of the Wall Street Journal includes an article by Jeffrey Trachtenberg entitled E-Books Rewrite Bookselling. Instructions Read the article and answer the following...

-

Scott Bestor is an accountant for Westfield Company. Early this year, Scott made a highly favorable projection of sales and profits over the next 3 years for Westfields hot-selling computer PLEX. As...

-

Scott Bestor is an accountant for Westfield Company. Early this year, Scott made a highly favorable projection of sales and profits over the next 3 years for Westfields hot-selling computer PLEX. As...

-

Horizontal Analysis The comparative accounts payable and long-term debt balances of a company are provided below. Current Year Previous Year Accounts payable $47,286 $63,900 Long-term debt 85,492...

-

On January 1, Year 1, Price Company issued $140,000 of five-year, 7 percent bonds at 97. Interest is payable annually on December 31. The discount is amortized using the straight-line method. Record...

-

Logistics Solutions provides order fulfillment services for dot.com merchants. The company maintains warehouses that stock items carried by its dot.com clients. When a client receives an order from a...

Study smarter with the SolutionInn App