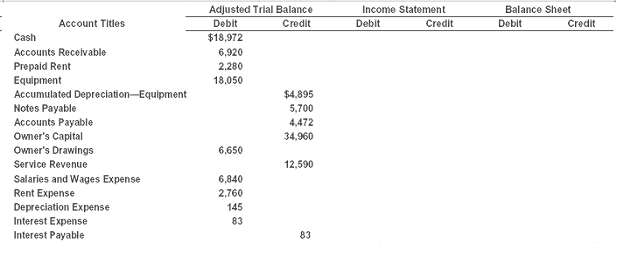

The adjusted trial balance for Madrasah Co. is presented in the following worksheet for the month ended

Question:

The adjusted trial balance for Madrasah Co. is presented in the following worksheet for the month ended April 30, 2012.

InstructionsComplete the worksheet and prepare a classified balancesheet.

Transcribed Image Text:

Adjusted Trial Balance Debit Income Statement Balance Sheet Account Titles Credit Debit Credit Debit Credit Cash $18,972 Accounts Recelvable 6,920 Prepaid Rent Equipment Accumulated Depreciation-Equipment 2.280 18.050 $4.895 5,700 Notes Payable Accounts Payable Owner's Capital Owner's Drawings 4,472 34,960 6,650 Service Revenue 12.590 Salaries and Wages Expense 6,840 2,760 Rent Expense Depreciation Expense 145 Interest Expense 83 Interest Payable 83

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 55% (18 reviews)

MADRASAH CO Worksheet Partial For the Month Ended April 30 2012 Adjusted Trial Balance Income Statem...View the full answer

Answered By

OTIENO OBADO

I have a vast experience in teaching, mentoring and tutoring. I handle student concerns diligently and my academic background is undeniably aesthetic

4.30+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Accounting questions

-

Following are selected accounts from the adjusted trial balance for Roberts Shop, Inc., as of March 31, 2011, the end of the fiscal year. The merchandise inventory for Roberts Shop was $38,200 at the...

-

The adjusted trial balance for Speedy Courier as of December 31, 2016, follows. Required 1. Use the information in the adjusted trial balance to prepare (a) the income statement for the year ended...

-

The adjusted trial balance for Chiara Company as of December 31, 2017, follows. Required 1. Use the information in the adjusted trial balance to prepare (a) The income statement for the year ended...

-

Kim and Kanye have been dating for years and are now thinking about getting married. As a financially sophisticated couple, they want to think through the tax implications of their potential union....

-

King Corp., a private company reporting under ASPE, reported the following for the years ended July 31, 2017 and 2016: Additional information: 1. Profit for 2017 was $106,500. 2. Common shares were...

-

The angle between two forces, each of magnitude 5.0 N, is 120. What is the magnitude of the resultant of these two forces? A. 1.7 N B. 5.0 N C. 8.5 N D. 10 N 120 5.0 N 5.0 N Figure 4.28

-

What resources and capabilities might be needed for a transition from a paper-based information company to an Internet-based information company? Describe and. explain.

-

The Shank Corporation issued $1,500,000 of 10% convertible bonds for $1,620,000 on March 1, 2006. The bonds are dated March 1, 2006, pay interest semiannually on August 31 and February 28, and the...

-

Paynesville Corporation manufactures and sells a preservative used in food and drug manufacturing. The company carries no inventories. The master budget calls for the company to manufacture and sell...

-

Journalize the following transactions into the general journal. The chart of accounts, the trial balance from January, 1 2020, schedule of accounts payable, and the schedule of accounts receivable is...

-

Presented below are selected accounts for Acevedo Company as reported in the worksheet at the end of May 2012. InstructionsComplete the worksheet by extending amounts reported in the adjusted trial...

-

Letterman Co. prepares monthly financial statements from a worksheet. Selected portions of the January worksheet showed the following data. During February no events occurred that affected these...

-

Chesterfield County had the following transactions. Prepare the entries first for fund-based financial statements and then for government-wide financial statements. a. A budget is passed for all...

-

Identify a public conflict (such as a recent Congressional debate or even a celebrity breakup) that has come to the forefront in the media (or public's attention) in the last thirty days. You have...

-

Performance Management Issues You have been asked to return to your alma mater and speak to current students about performance management issues. To make the most of this experience for yourself and...

-

Analysis of competitor organization of our selected organization Walmart and its competitor Safeway. 1. Complete analysis of competitor organization; addresses all relevant factors and typically uses...

-

Defining Program Objectives of Youth centers Clearly define the objectives of your program or center. What specific outcomes do you hope to achieve? Examples may include promoting physical fitness,...

-

Identify a local or regional organization and analyze how they demonstrate servant leadership in their operations. You will want to review their website, social media, news, and other resources to...

-

Tariffs are on imports or exports. In the United States, tariffs on (imports, exports) are illegal under the Constitution.

-

In the circuit shown in Figure 4, a battery supplies a constant voltage of 40 V, the inductance is 2 H, the resistance is 10, and l(0) = 0. (a) Find l(t). (b) Find the current after 0.1s.

-

Suppose 20.0 g of NaBr(s) is added to 50.0 mL of a 2.00 M silver nitrate solution. (a) Write a net ionic equation for the formation of the expected precipitate. (b) What is the theoretical yield of...

-

Access the FASB Codification at asc.fasb.org/home to conduct research using the Codification Research System to prepare responses to the following items. Provide Codification references for your...

-

What is meant by a dilutive security?

-

What is meant by a dilutive security?

-

The payroll register of Ruggerio Co. indicates $13,800 of social security withheld and $3,450 of Medicare tax withheld on total salaries of $230,000 for the period. Federal withholding for the period...

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

Study smarter with the SolutionInn App